Biodiversity Credit Project Facilitators

ValueNature is actively facilitating the development of 4 nature investment and biodiversity credit projects that spans over 500,000 hectares across 4 countries in the Global South to bring to market by 2024. Across these projects we are working on nature crediting pilots with both Plan Vivo in Uganda and Verra in Zambia and South Africa, actively contributing to the development of their Nature crediting methodologies, while concurrently developing our own.

The projects we are working on will ensure investments deliver exceptional biodiversity and social returns that are measurable, verifiable and reportable. ValueNature offers biodiversity credit buyers the chance to engage meaningfully with biodiversity conservation by ensuring their investments reach the stakeholders in the nature-based commodity chain that matter – the biodiversity custodians on the ground.

Milestones & Achievements

- Currently developing one of the world’s biggest biodiversity credit projects, in NE Zambia.

- BloombergNEF rated ValueNature as one of the top biodiversity methodology developers.

- Grant funding received with IIED from the UK Government’s Darwin Initiative to pilot 2 biodiversity credit projects in partnership with local NGOs Conserve Global and ECOTRUST.

- ValueNature are founding partners and acted as the Biodiversity Credit Alliance’s start-up coordinators, working the UNDP & UNEP-FI to bring this alliance to life. We currently sit in the secretariat while handing over the coordination role and are active members of many of the TaskForces’ working groups.

- ValueNature are currently collating a set of Biodiversity Integrity and Governance (BIG) principles and incorporating them into an Associated Biodiversity Standard with two other methodology developers.

- ValueNatue is collaborating with other methodology developers on identifying unified frameworks which will align under the Associated Biodiversity Standard. This will be the investment framework for which our projects will be registered and against which Nature Investment Certificates will be certified.

Monitoring, Reporting and Verification

Monitoring will be designed to detect ecosystem changes, specifically in habitats and wildlife populations, to inform an Ecosystem Integrity score, with data gathered using locally deployed bioacoustics sensors and wildlife camera traps, locally collected eDNA samples, and satellite imagery.

Data analysis will be conducted by biometrio.earth, a specialist company based in Germany whose members have been doing biodiversity data collection and analysis at these large landscape scales for over 20 years

Investment Framework

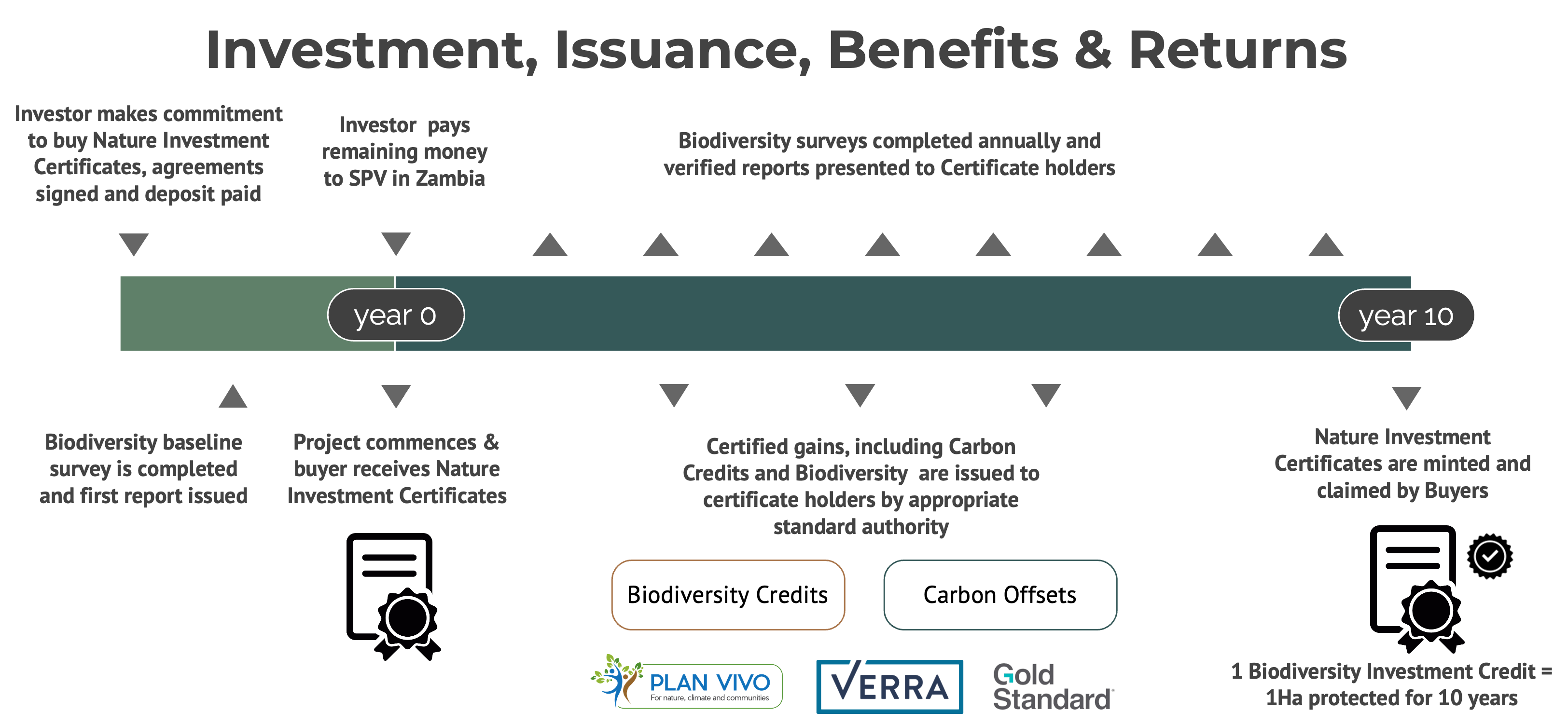

Nature Investment Certificates

A Nature Investment Certificate (NIC) is a 10-year contractual agreement to conserve or restore 1 hectare of land. The funds raised from NIC sales are allocated according to a detailed conservation management plan and budget. This covers the costs of conservation actions, community support and payouts, government fees, and all monitoring, reporting, and verification (MRV) expenses for the project’s decade-long duration.

Benefits and Returns to Investors

Nature Investment Certificate holders benefit from verified ecosystem and social gains, which are reported on over the ten-years via ValueNature’s Investor Dashboard. This allows investors to validate their contributions and make claims.

Biodiversity Credit returns

A Voluntary Biodiversity Credit represents a measured and evidenced-based unit of biodiversity gain and is differentiated from biodiversity offsets. Although none of the notable standard setters have finalised their methodologies to measure a Biodiversity Unit of Gain (Biodiversity Credit), ValueNature are working on 3 projects that have been identified as pilots, two for the Verra Nature Framework and one Plan Vivo’s Nature methodology. As such we will ensure that our biodiversity measurements will be able to comply with any of these standards requirements, allowing Biodiversity Credits to be issued by the relevant standard authority at that point in time.

Carbon Credit returns

For applicable projects, Nature Investment Certificate holders can expect voluntary carbon offsets as a result of the biodiversity management interventions they have supported. This will include supporting more sustainable grasslands management, fire management, preventing deforestation, or working on restoration and reforestation activities. In combination these initiatives will support increases in natural capital from baseline levels and support overall improvements in soil health, land degradation and climate resilience. Carbon credits issued against projects can hold additional certification, for example CCB certification from Verra, but project reporting will go beyond any current requirements, ensuring the highest integrity and quality of Carbon Credits globally available.

Benefits and Returns to Biodiversity Custodians

We will ensure that 80 % of revenue generated from the Biodiversity Credits are passed on to the custodians responsible for protecting and growing these assets – this being indigenous people and local communities who have always lived there, current land managers and the government responsible. Biodiversity Custodians will also benefit from any increases in credit value on secondary trades, as each digital certificate will have built in royalties for the Biodiversity Custodians of at least 50%.

Price Establishment

ValueNature adopts a comprehensive approach to pricing Nature Investment Certificates by closely examining various cost components that contribute to their creation and management. The foundation of our pricing structure begins with the ‘Cost of Production,’ which encapsulates the necessary investments for biodiversity protection and or restoration activities on the project site. This includes but is not limited to labour costs, materials, land management, and any required technological solutions.

Building on this base, we then consider the ‘Owner/Rights Holder Benefits,’ which account for the opportunity costs faced by landowners or community members involved in the project. Opportunity costs could include foregone agricultural revenue, alternative land-use options, or any other economic activities that stakeholders could engage in if not for the biodiversity project. This ensures that the local communities or individuals who forgo other revenue-generating activities for the sake of biodiversity are fairly compensated.

Lastly, we add the ‘Operational Costs’ associated with the entire credit lifecycle. This encompasses the costs incurred for monitoring the project’s biodiversity impact, periodic reporting to stakeholders, third-party verification processes, credit issuance, and finally, the transaction costs related to credit trading in the marketplace.

By systematically accounting for these multiple layers of costs, we aim to arrive at a price that not only covers the project’s expenses but also ensures equitable benefits for all stakeholders involved. This transparent and multi-dimensional pricing structure ensures the long-term viability of our biodiversity credits while fostering trust among investors, participants, and the broader community.

Methodology

ValueNature aims to accelerate the value recognition of nature through locally led deployment of sensor technologies to efficiently measure biodiversity at the site level and integrate it with remote sensing data to extrapolate this effort over a project site. We are actively working with our many partners, including biometrio.earth, to finalise our evidence-based and robust biodiversity metrics and measurement standards; enlisting best practice, technologically driven, cost effective and custodian led field survey techniques. Our partners include credible local wilderness custodians, conservation managers, research institutions, large and local NGOs and other biodiversity credit developers.

First Look: Zambia Project

North-eastern Zambia: Community Game Management Area

• This biodiversity credit project has received grant funding from the UK government funded Darwin Initiative, in association with IIED, along with private investment from Qarlbo Natural Asset Company in Sweden.

• This project will scale by 6X into the neighbouring Community GMA, increasing investment opportunities and returns.This project will scale by 6X into the neighbouring Community GMA, increasing investment opportunities and returns.

• This project is one of Verra’s 15 globally selected Nature Framework pilot project sites

Situated within a Key Biodiversity Area, sits a 44,000 Game Management Area (GMA) once famed for large wildlife herds and stunning landscapes, but has suffered due to ineffective past management, and has been sitting fallow in recent years. This has led to a decline in wildlife populations and annual forest loss of up to 2%. The GMA is a critically important ecosystem as it borders with and links two major National parks. A thriving, interconnected conservation landscape of over 1,3 million hectares can be assured only if this and its neighbouring GMA is effectively restored and managed. The local Chiefdom in partnership with the non-profit-organisation Conserve Global, now hold biodiversity management rights to this community wildlife concession through an SPV they have created.

What is next for the project

• Final negotiations between the project proponents as well as the Zambian Ministry of Green Economy are being concluded.

• Nature Investment Certificates will go on sale in Q1 2024, pending final Zambian Government approval.

• We are seeking pre-sale commitments for 10,000 credits, with a 20% deposit paid into the escrow account of our partner auditors.

• The project will commence 6-12 months after the sales date, with the first biodiversity and carbon gains to be created within 48 months.

Looking ahead and thinking scale

New Projects

We’re thrilled at the prospect of expanding our innovative approaches to a global scale, and are currently in collaboration with select key partners and communities to identify opportunities in new biodiverse landscapes that are looking for support. Our ambitions will extend beyond our initial successes; we’re actively exploring additional projects in sub-Saharan Africa as well as venturing into the rich and diverse ecosystems of Central and South America. Through these strategic partnerships, we aim to qualify and support projects that will make a meaningful impact in the emerging nature market.

DLT platforms for hyper transparency and verifiability

We have outlined the architecture for a distributed ledger technology (DLT) based platform that envisages to integrate our data sources and ensure our biodiversity claims can be traced along verifiable data generation and analysis steps. This proof of provenance will increase efficiencies in auditing and credit issuance, thereby reducing costs and ensuring more value goes to the biodiversity custodians. ValueNature will be the first biodiversity credit to stem from the newly launched Guardian Network and will implement the InterWork Alliance’s metadata structures, ensuring that our credits form part of a standardised marketplace, following principles the Biodiversity Credit Alliance and ourselves are currently contributing towards. ValueNature biodiversity credits will be traded publicly and discoverable on a public ledger, allowing for traceability and complete transparency.

Our Team

We bring together unique international experience across Wildlife, Community Custodians, Tech and Finance

Simon Morgan

Co-founder & CEO

Simon has a PhD in conservation ecology with a focus on threatened species. He has been working to bridge the gap between research and conservation management for over 15 years and for Stanford University for the last 3 years.

Gavin Erasmus

Co-founder & CTO

Gavin is an experienced entrepreneur and was CTO & co-founder of Sheep Inc – the world’s first carbon negative fashion brand. He has worked on numerous Biodiversity Finance initiatives and is a FinTech and Blockchain expert.

Johan Maree

Co-founder & COO

Jo has a Master’s degree in development finance. A social entrepreneur at heart, he has co-founded and led businesses and organisations addressing challenges in fields ranging from species conservation, biotech and sustainable tourism.

Contact Us

Please get in touch if you would like to learn more.